All Categories

Featured

Table of Contents

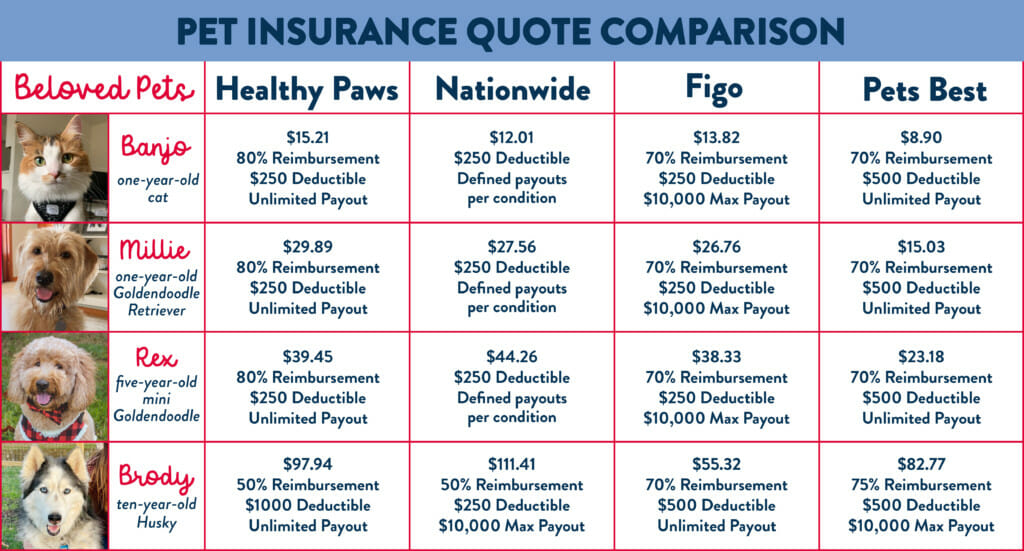

Similar to in human medicine, you can maintain your costs reduced by selecting a high insurance deductible, a lower repayment price or a lower, protection limit. Since the firm Veterinary Animal Insurance (VPI) was developed in California by a team ofveterinarians in the late 1970s many firms have come and gone. VPI was bought byNationwide several years ago and is still one of the leaders in the market yet there are several trustworthy companies in the market now.

As veterinary medication becomes extra technologically progressed, the price of treatment rises. That's due to greater prices associated with the devices, centers and training called for to provide these higher-quality solutions (pet insurance). Pet health and wellness insurance can help by balancing out some or a lot of the costs of diagnosing, treating and managing your family pet's ailment or injury

Talk with your veterinarian about it, and research your alternatives. AVMA's plan on pet dog health and wellness insurance policy define numerous stipulations that are necessary in insurance plan. Here are some standard considerations: No matter the insurance provider, your vet ought to be keeping an eye on the health of your animal as component of a veterinarian-client-patient partnership. All fees, including co-pays, deductibles, add-on costs and other fees, must be plainly described to you so you completely recognize the plan and its constraints. You must be allowed to pick the vet who will take care of your family pet. Family pet insurance coverage plans are generally repayment strategies you pay the expenses up front and are compensated by the insurance policy carrier.

Some Known Questions About Comprehensive Guide To Comprehensive, Accident-only, And ....

If you're concerned concerning covering the expenditures in advance, ask your veterinarian regarding settlement alternatives that will certainly work for you in situation you require to make plans. It's best to understand your alternatives in advance of time so you don't have the included stress and anxiety of attempting to make payment arrangements throughout an emergency.

There are customer websites that compare attributes and expenses of pet dog insurance policy, and/or deal reviews, and you might locate these practical. The AVMA does not endorse or recommend any type of supplier over others.

The coverage one sort of plan deals may vary from one pet insurance provider to the next, so pay close interest to the details when looking for a pet dog insurance coverage policy. As the name recommends, these policies just cover (qualified) injuries or medical problems that are accidental. For instance, an accident-only plan will not cover optional surgical procedure to get rid of a lump, however it should cover veterinarian costs for points like busted bones or lacerations.

Our Compare Pet Insurance Plans & Quotes - Moneygeek.com Diaries

If your goofball young puppy swallows an international object or something hazardous, your insurance firm will likely foot the resulting vet bill. If you're on a budget, an accident-only plan may be a great choice for you and your pets.

Here's a look at the type of problems these pet dog insurance policies do and do not cover. pet insurance. Caret Down Symbol Burns Bite wounds Bloat Broken toe nails Broken bones Eye injury Contaminant or things intake Fractured teeth Intoxication Lacerations Poisoning Torn cruciate ligaments Caret Down Icon Diseases (bacterial or viral) Regular vet sees A mishap and illness plan provides one of the most thorough family pet insurance policy, covering both injuries and illnesses

Think about a copayment as an "gain access to" cost that you pay to get your reimbursement.: This is the quantity you require to pay of pocket before your protection kicks in. The higher the insurance deductible, the lower your month-to-month premium, it's all regarding stabilizing what help your spending plan.

Table of Contents

Latest Posts

Examine This Report on Could Your Veterinary Practice Be More Efficient? - Vet Hero Software

An Unbiased View of Veterinary Practice Management Software For Clinic - Chetu

The smart Trick of Choosing The Perfect Dog Bed: A Comprehensive Guide That Nobody is Discussing

More

Latest Posts

Examine This Report on Could Your Veterinary Practice Be More Efficient? - Vet Hero Software

An Unbiased View of Veterinary Practice Management Software For Clinic - Chetu

The smart Trick of Choosing The Perfect Dog Bed: A Comprehensive Guide That Nobody is Discussing